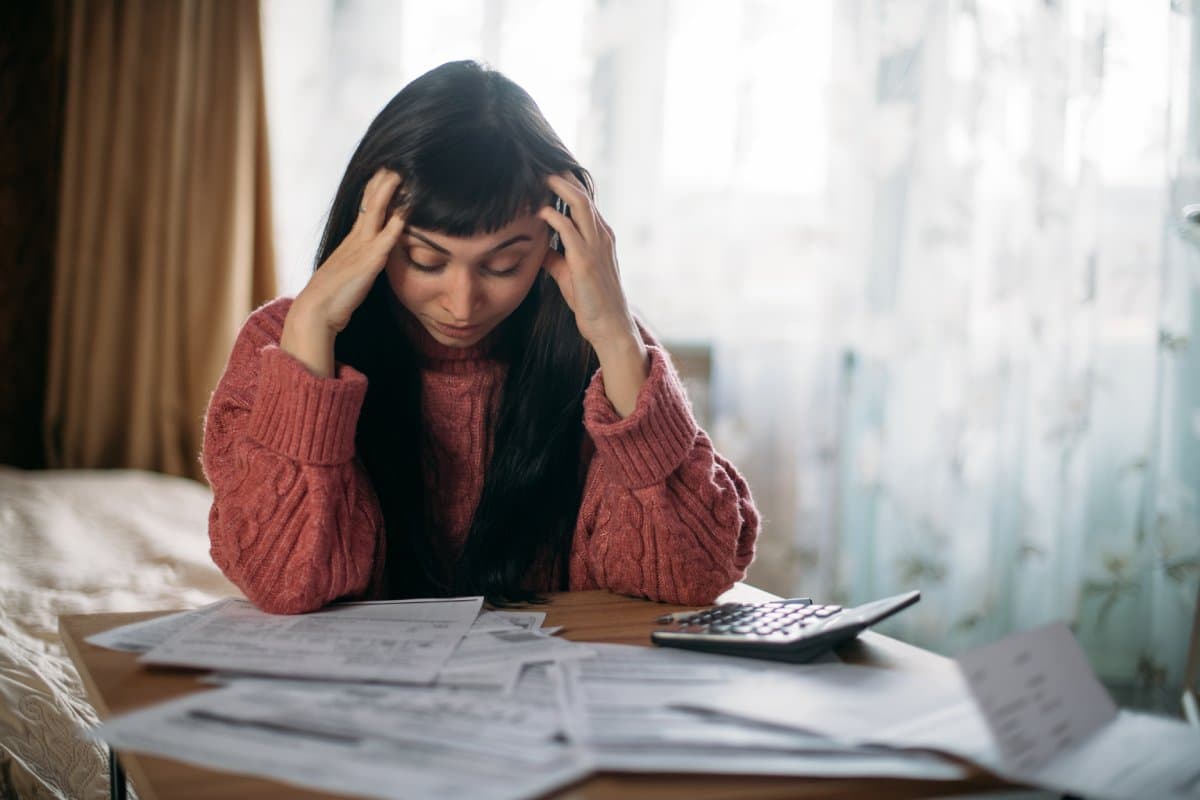

The middle class often feels the squeeze from all sides—earning too much to qualify for many assistance programs but not enough to easily absorb rising costs. With the Biden administration navigating these turbulent waters, here’s why being middle class can feel financially precarious.

1. Stagnant Wages

Despite economic growth, middle-class wages have largely stagnated, failing to keep pace with inflation, which diminishes purchasing power and financial security.

2. Healthcare Costs

Healthcare expenses continue to rise, and even with the Affordable Care Act in place, many middle-class families struggle with high premiums, deductibles, and out-of-pocket costs.

3. Housing Market Instability

With home prices soaring, especially in urban areas, the middle class finds it increasingly difficult to afford homeownership, a key component of financial stability.

4. Education Expenses

The cost of higher education keeps climbing, and middle-class families often earn too much to qualify for significant financial aid but not enough to avoid burdensome student loan debt.

5. Limited Social Mobility

Economic policies have not significantly addressed social mobility, making it hard for middle-class individuals to improve their financial standing significantly.

6. Tax Burdens

While the Biden administration has proposed tax reforms aimed at the wealthy, many middle-class Americans feel they bear a disproportionate tax burden without corresponding benefits.

7. Retirement Insecurity

With pensions becoming rare and the future of Social Security uncertain, saving for retirement is a significant stressor, with many middle-class workers feeling unprepared.

8. Consumer Debt

Credit card debt, auto loans, and personal loans can accumulate quickly, especially for middle-class households trying to maintain their standard of living amidst rising costs.

9. Job Market Volatility

Technological advancements and outsourcing continue to transform the job market, often to the detriment of middle-class jobs in traditional sectors.

10. Inadequate Government Assistance

Many government assistance programs are geared toward low-income individuals, leaving middle-class families without much-needed support during economic downturns or health crises.

11. Investment Risks

The middle class often lacks the disposable income to diversify investments, making their limited investments riskier, especially in volatile markets.

12. Lack of Emergency Savings

A significant portion of middle-class families lacks sufficient emergency savings, making unexpected expenses a potential financial disaster.

13. Rising Childcare Costs

Childcare costs are a massive burden for middle-class families, consuming a large portion of monthly income and limiting financial flexibility.

14. Economic Policy Shifts

Changes in economic policy, whether from new legislation or administration priorities, can have unpredictable impacts on the middle class.

15. Healthcare Policy Uncertainty

Ongoing debates over healthcare policy, including threats to dismantle or diminish Obamacare, create significant uncertainty and potential vulnerability for middle-class families.

16. Dependency on Dual Incomes

Many middle-class households depend on dual incomes to make ends meet, which can be risky in the event of job loss or illness affecting one income earner.

17. Inflation Impact

Inflation reduces the buying power of the middle class, whose income does not typically fluctuate with inflation trends.

18. Underemployment

The issue of underemployment, where workers are employed at jobs for which they are overqualified or part-time when they need full-time positions, is particularly acute among the middle class.

19. Savings Rate

The savings rate among middle-class families has not recovered adequately since the last recession, limiting their ability to invest in future growth or withstand financial shocks.

20. The Digital Divide

As the economy increasingly shifts online, the digital divide leaves some middle-class families without adequate access to technological resources, impacting education and job opportunities.

21. Climate Change

The financial implications of climate change, including property damage from natural disasters and increased insurance premiums, disproportionately affect middle-class homeowners.

Navigating Uncertain Waters

The financial challenges facing the middle class under the Biden administration highlight the need for targeted policy reforms that address these risks directly. It’s essential for middle-class Americans to engage politically and advocate for policies that enhance economic security and mobility.

Remote No More: 19 Companies Returning to the Office

As the pandemic wanes, companies are recalling remote workers back to the office, sparking debates on fairness, costs, and convenience. However, there are also notable productivity, coworking, and mental health benefits to consider. Feeling the effects of these changes? Remote No More: 19 Companies Returning to the Office

8 Costco Must Buys and 8 to Leave Behind

Ever wandered Costco’s aisles, questioning if that giant jar of pickles is a real bargain? Or debated buying tires where you get your rotisserie chicken? Welcome to the definitive guide to Costco shopping—a journey to save money, prevent regrets, and offer quirky insights into bulk buying. 8 Costco Must Buys and 8 to Leave Behind

23 Reasons Texas Is the Next Big Thing

Texas is becoming a beacon of opportunity, blending cultural heritage with economic growth. From its landscapes to its industries, the Lone Star State offers a dynamic lifestyle. Here are 23 reasons why Texas stands out, attracting entrepreneurs, artists, tech professionals, and families seeking new beginnings. 23 Reasons Texas Is the Next Big Thing

15 Top Sites to Sell Your Unwanted Goods Besides Craigslist

Selling your unwanted items can declutter your space and boost your income. While Craigslist is popular, there are many alternatives with unique features and wider audiences. Explore these 15 Craigslist alternatives for selling everything from furniture to electronics, finding the perfect platform to turn clutter into cash. 15 Top Sites to Sell Your Unwanted Goods Besides Craigslist

Work from Anywhere: 19 Companies Still Supporting Remote Work

Tired of commuting and craving work flexibility? You’re not alone. Many companies now offer remote work, benefiting both employees and employers. Ever wondered how this shift could enhance your work-life balance? Work from Anywhere: 19 Companies Still Supporting Remote Work

The post – 21 Reasons Why Being Middle Class Is Now Financially Risky – first appeared on Liberty & Wealth.

Featured Image Credit: Shutterstock / Grusho Anna.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.