Planning for retirement is crucial, but there are many pitfalls that can derail your dreams of a comfortable and happy retirement. Here are 21 pitfalls you should be aware of to ensure you’re fully prepared for your golden years.

1. Underestimating Healthcare Costs

Healthcare costs can skyrocket in retirement. Many retirees are surprised by the high cost of medical care, prescriptions, and long-term care, which can quickly deplete savings.

2. Not Having a Clear Retirement Plan

Failing to plan is planning to fail. Without a clear retirement strategy, you may outlive your savings or not have enough to maintain your desired lifestyle.

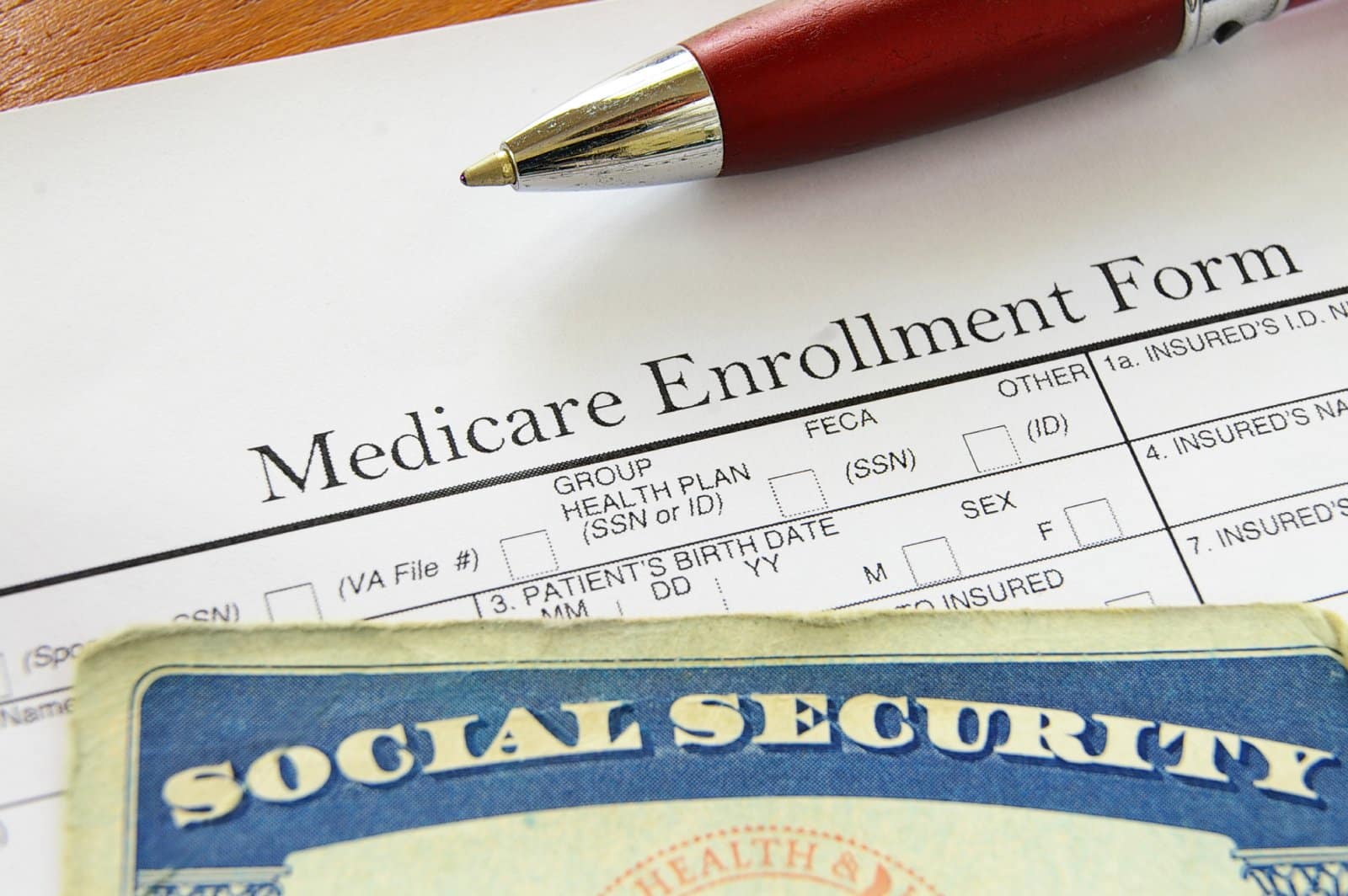

3. Relying Solely on Social Security

Social Security is a safety net, not a full retirement plan. It’s important to have additional sources of income, such as savings, pensions, or investments.

4. Ignoring Inflation

Inflation erodes purchasing power over time. Make sure your retirement savings and investments account for inflation to ensure your money retains its value.

5. Not Diversifying Investments

Putting all your eggs in one basket is risky. Diversify your investments to protect against market volatility and reduce risk.

6. Withdrawing Savings Too Quickly

Taking large withdrawals from your retirement accounts can lead to premature depletion of funds. Plan a sustainable withdrawal strategy to ensure your savings last.

7. Neglecting to Update Your Will and Estate Plan

An outdated will or estate plan can cause legal complications and family disputes. Regularly update these documents to reflect your current wishes and financial situation.

8. Failing to Consider Taxes

Taxes can take a big bite out of your retirement income. Understand the tax implications of your retirement accounts and plan accordingly to minimize taxes.

9. Overlooking Long-Term Care Insurance

Long-term care can be incredibly expensive. Without insurance, you may have to spend down your assets to qualify for Medicaid, significantly impacting your financial security.

10. Retiring Too Early

Retiring before you’re financially ready can lead to financial stress and reduced quality of life. Make sure you have enough savings to support a long retirement.

11. Underestimating Life Expectancy

People are living longer than ever. Underestimating your life expectancy can result in outliving your savings. Plan for a longer retirement to ensure financial security.

12. Ignoring the Need for a Budget

A budget helps control spending and ensures you live within your means. Without one, you risk overspending and depleting your retirement savings.

13. Carrying Debt into Retirement

Entering retirement with significant debt can strain your finances. Aim to pay off debt before retiring to reduce financial pressure.

14. Not Considering Part-Time Work

Part-time work can supplement your income and provide social engagement. Dismissing this option can lead to financial shortfalls and a less fulfilling retirement.

15. Mismanaging Required Minimum Distributions (RMDs)

Failing to take RMDs from your retirement accounts can result in hefty penalties. Understand the rules and plan your withdrawals to avoid unnecessary costs.

16. Not Adjusting Spending in Down Markets

Spending as usual during market downturns can quickly drain your retirement savings. Be prepared to adjust your spending based on market conditions.

17. Neglecting to Factor in Housing Costs

Housing is often the largest expense in retirement. Plan for potential increases in property taxes, maintenance, and other housing-related costs.

18. Underestimating the Impact of Market Volatility

Market volatility can significantly impact your retirement savings. Have a diversified investment strategy to protect against major losses.

19. Failing to Seek Professional Advice

Professional financial advice can help you navigate complex retirement planning issues. Don’t hesitate to seek guidance to ensure you’re on the right track.

20. Not Taking Advantage of Catch-Up Contributions

If you’re over 50, you can make catch-up contributions to your retirement accounts. Maximize these opportunities to boost your savings.

21. Neglecting Personal Fulfillment

Retirement is not just about finances; it’s about enjoying your golden years. Plan for hobbies, travel, and activities that bring you joy and fulfillment.

Stay Informed and Prepared

Avoiding these common pitfalls can help ensure a secure and enjoyable retirement. By planning ahead, staying informed, and making smart financial decisions, you can protect your future and truly enjoy your golden years.

Remote No More: 19 Companies Returning to the Office

As the pandemic wanes, companies are recalling remote workers back to the office, sparking debates on fairness, costs, and convenience. However, there are also notable productivity, coworking, and mental health benefits to consider. Feeling the effects of these changes? Remote No More: 19 Companies Returning to the Office

8 Costco Must Buys and 8 to Leave Behind

Ever wandered Costco’s aisles, questioning if that giant jar of pickles is a real bargain? Or debated buying tires where you get your rotisserie chicken? Welcome to the definitive guide to Costco shopping—a journey to save money, prevent regrets, and offer quirky insights into bulk buying. 8 Costco Must Buys and 8 to Leave Behind

23 Reasons Texas Is the Next Big Thing

Texas is becoming a beacon of opportunity, blending cultural heritage with economic growth. From its landscapes to its industries, the Lone Star State offers a dynamic lifestyle. Here are 23 reasons why Texas stands out, attracting entrepreneurs, artists, tech professionals, and families seeking new beginnings. 23 Reasons Texas Is the Next Big Thing

15 Top Sites to Sell Your Unwanted Goods Besides Craigslist

Selling your unwanted items can declutter your space and boost your income. While Craigslist is popular, there are many alternatives with unique features and wider audiences. Explore these 15 Craigslist alternatives for selling everything from furniture to electronics, finding the perfect platform to turn clutter into cash. 15 Top Sites to Sell Your Unwanted Goods Besides Craigslist

Work from Anywhere: 19 Companies Still Supporting Remote Work

Tired of commuting and craving work flexibility? You’re not alone. Many companies now offer remote work, benefiting both employees and employers. Ever wondered how this shift could enhance your work-life balance? Work from Anywhere: 19 Companies Still Supporting Remote Work

The post – 21 Retirement Pitfalls That Can Ruin Your Golden Years – first appeared on Liberty & Wealth.

Featured Image Credit: Shutterstock / shurkin_son.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.