Trump has proposed ending income taxes on Social Security benefits. Statements like these are likely to appeal to American retirees, an important group for Trump in the upcoming presidential election.

Social Security Taxes

With the presidential election coming up, Social Security taxes have become a hot topic. Former President Donald Trump just announced his plan to make big cuts to these taxes, a decision that’s had mixed responses.

Trump’s Plan

Trump has proposed completely getting rid of Social Security taxes for all income levels. This claim closely aligns with his platform which relies on tax reform and relief for Americans.

“No Tax for Seniors”

“People on Social Security are being killed, and one of the things I’m doing is no tax for seniors on Social Security, and I’ll get it done quickly,” Trump recently said.

Social Security Funding

Although the idea sounds nice in theory, many experts are concerned about the potential of a funding shortfall for Social Security if Trump gets elected. Future retirees may not be able to access the same benefits as current ones.

Benefits for Retirees

This decision would provide massive tax relief to millions of Americans. Since the 1980s, Social Security has been taxed in order to make up some of the necessary financing. This decision would be a huge benefit for current recipients.

A Different Tax Approach

Trump’s statement has also come at a crucial time in the election. While his prior tax cuts have been criticized by Democrats as only helping wealthy Americans and corporations, this move is one that emphasizes Trump’s commitment to working-class Americans.

Immediate Financial Relief

Supporters of this plan argue that eliminating these taxes would be an immediate financial relief to taxpayers. This could boost consumer spending and help the economy.

Federal Deficit Concerns

On the other hand, many are concerned that this decision would reduce current tax revenue and increase the federal deficit. In this case, other cuts would need to be made on the federal program, or the government would need to borrow more money.

Where’s the Money Coming From?

Jess Lee, a former Biden White House official, is concerned about where the money will come from. “We’re all for people having their lunch, but we have to raise taxes on the wealthy to pay for it.”

Current Tax System

Currently, the government has a specific formula for calculating Social Security taxes. Half of the payments are considered to be income, so those making more than $25,000 are taxed up to 50% and those making more than $34,000 may have to pay up to 85%.

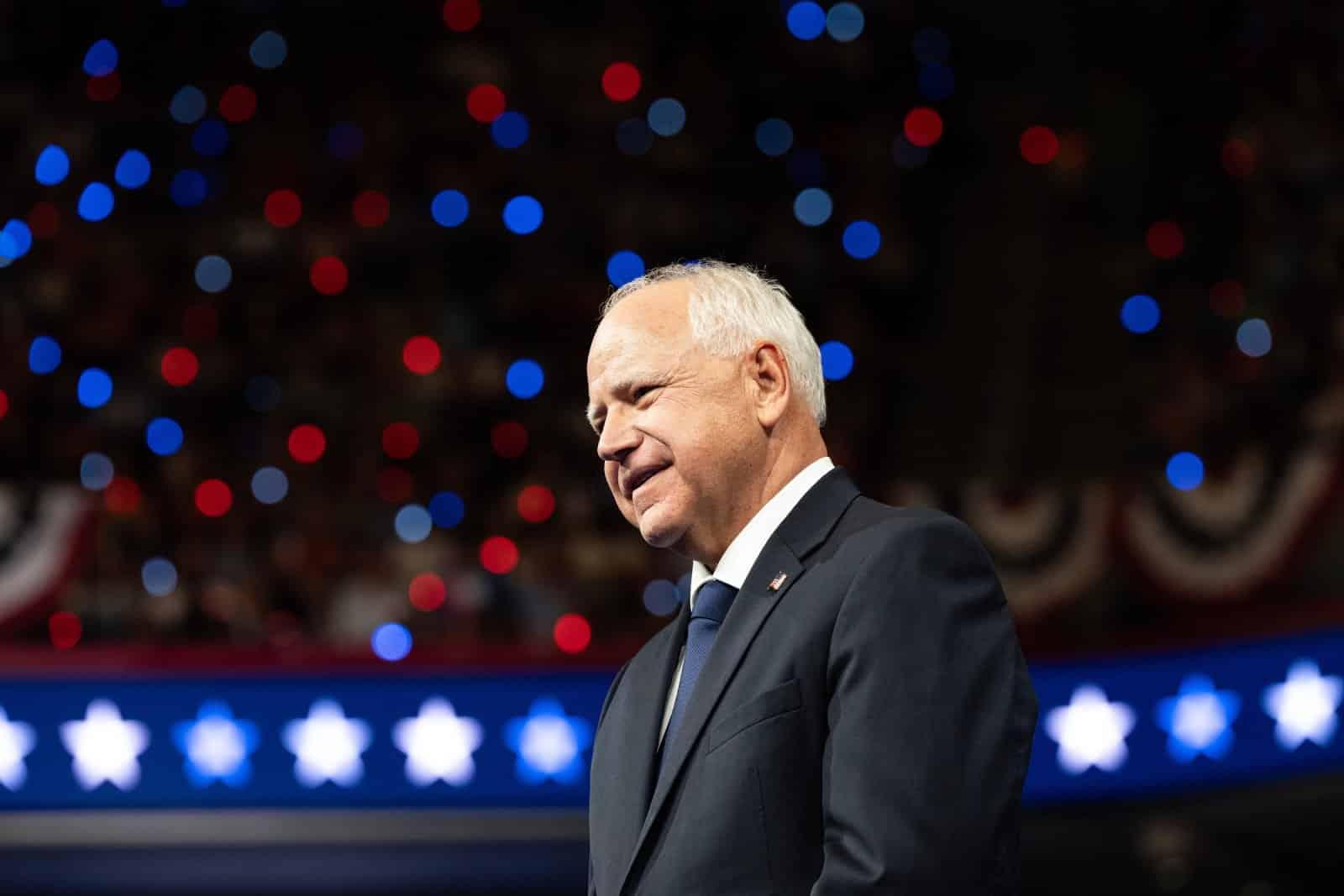

Tim Walz’ Former Approach

Vice Presidential candidate, Tim Walz, has approached tax exemption during his time as Minnesota Governor. He focused on raising the threshold for taxing Social Security income, which eliminated the tax for most seniors.

Future Plans

These plans had a significantly lower cost to the government than Trump’s proposed exemptions. How the Harris-Walz team approaches Social Security tax cuts in the future will be crucial for them.

Public View of Trump’s Proposal

Generally, tax cuts are popular among all voters, especially within the Republican party. Trump’s plans could expand his voter appeal to working-class and small business voters.

Shifted Burden

The biggest issue the future President will need to tackle is how to address shifting the burden for Social Security taxes to the younger working classes.

Young Workers Suffer

“I can see the political calculations behind this proposal, but from a tax fairness perspective and a generation fairness perspective, it is a very bad proposal,” said Romina Boccia, director of budget and entitlement policy at Cato Institute.

Social Security Debates

The Social Security system is already heavily debated, as many believe the current structure will not hold up in the long-term. Many experts predict that younger Americans won’t have access to Social Security by the time they retire.

Balancing Tax Cuts and Services

Both Trump and Harris will need to figure out how to best balance tax cuts that appeal to the average American while still funding essential services, including Social Security itself.

Bipartisan Support

Generally, cutting Social Security taxes has bipartisan support. However, the approach and extremes of these relief efforts may ultimately prove difficult to pass.

The Election Year

This year is the presidential election, making it especially important for both Trump and Harris to appeal to voters. At times like this, rhetoric runs high and full of promises, as both candidates try to expand their reach.

Different Approaches

The debate over Social Security taxes reflects some of the bigger discussions on economic equity, fiscal responsibility, and political strategy. These differing approaches show us the candidates’ respective priorities.

Remote No More: 19 Companies Returning to the Office

As the pandemic wanes, companies are recalling remote workers back to the office, sparking debates on fairness, costs, and convenience. However, there are also notable productivity, coworking, and mental health benefits to consider. Feeling the effects of these changes? Remote No More: 19 Companies Returning to the Office

8 Costco Must Buys and 8 to Leave Behind

Ever wandered Costco’s aisles, questioning if that giant jar of pickles is a real bargain? Or debated buying tires where you get your rotisserie chicken? Welcome to the definitive guide to Costco shopping—a journey to save money, prevent regrets, and offer quirky insights into bulk buying. 8 Costco Must Buys and 8 to Leave Behind

23 Reasons Texas Is the Next Big Thing

Texas is becoming a beacon of opportunity, blending cultural heritage with economic growth. From its landscapes to its industries, the Lone Star State offers a dynamic lifestyle. Here are 23 reasons why Texas stands out, attracting entrepreneurs, artists, tech professionals, and families seeking new beginnings. 23 Reasons Texas Is the Next Big Thing

Featured Image Credit: Shutterstock / Evan El-Amin.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.