Borrowers in the United States owe a total of over $1 trillion to credit card companies. The average American owes $6,218. These are the factors influencing the rise in debts.

Inflation Affecting Most Americans

At this point in the year, most American families and individuals who do not fall into uber-wealthy categories are feeling the effects of inflation. Everything from housing prices to groceries to medical bills are higher than ever, and wages have largely remained stagnant.

Cost of Living Steadily Increases

In fact, there has not been an increase in the federal minimum wage since 2009. In that fifteen year period, the cost of living has increased significantly. According to the Federal Reserve Bank of Minneapolis’s online inflation calculator, $1 in 2009 is equivalent to $1.42 as of 2023.

Wages Remain Stagnant

As the cost of living increases but earnings do not, the potential for Americans to rely on credit cards for survival goes up. While some people use credit cards to fund frivolous purchases like vacations and designer apparel, others are leaning on their available credit for basic needs.

Credit Cards as a Crutch

Notably, people in the lowest income brackets are more likely to rely on credit cards to help with expenses like utilities, groceries, gas, and even rent. In just the last quarter of 2023, American consumers added a whopping $50 billion in credit card debt.

Holiday Rush

The timing is not a coincidence. Many families needed the buffer to get through the holidays and colder weather months. It’s not about living outside of their means, either.

Inflation at the Grocery Store

The same bag of groceries that costs $30 today was $20 in 2009, but the minimum wage earner buying those groceries still makes $7.25 per hour based on the federal minimum.

Sacrifices and Tough Calls

The necessities have not changed, so people are forced to make a decision between going without needs or taking on debt to cover them.

Pandemic-Era Assistance Halting

Another driving factor is the fact that during the pandemic, families whose income sources were impacted relied on government assistance programs to make ends meet. Now that those programs have ended, many people are struggling as they still feel the effects of the pandemic.

Rising Interest Rates

Because interest rates have also been steadily increasing, the cost of using credit cards is higher than ever. While the rates may have been manageable at the time the card was swiped, the payments may be an extreme burden now that rates have gone up.

Did the Pandemic Affect Americans’ View of Budgeting?

Some financial experts have suggested that the pandemic caused people to grow accustomed to a certain standard of living with wiggle room in the budget.

A Financial Buffer

Since extra expenses like vacations and restaurants weren’t coming out, some people enjoyed a bit of breathing room financially.

The Haves vs. the Have-Nots

But for the less fortunate, vacations and restaurants were never a part of the equation. The bigger issue has been the rising costs of living. Bills that cannot be cut from the budget have grown at an alarming rate.

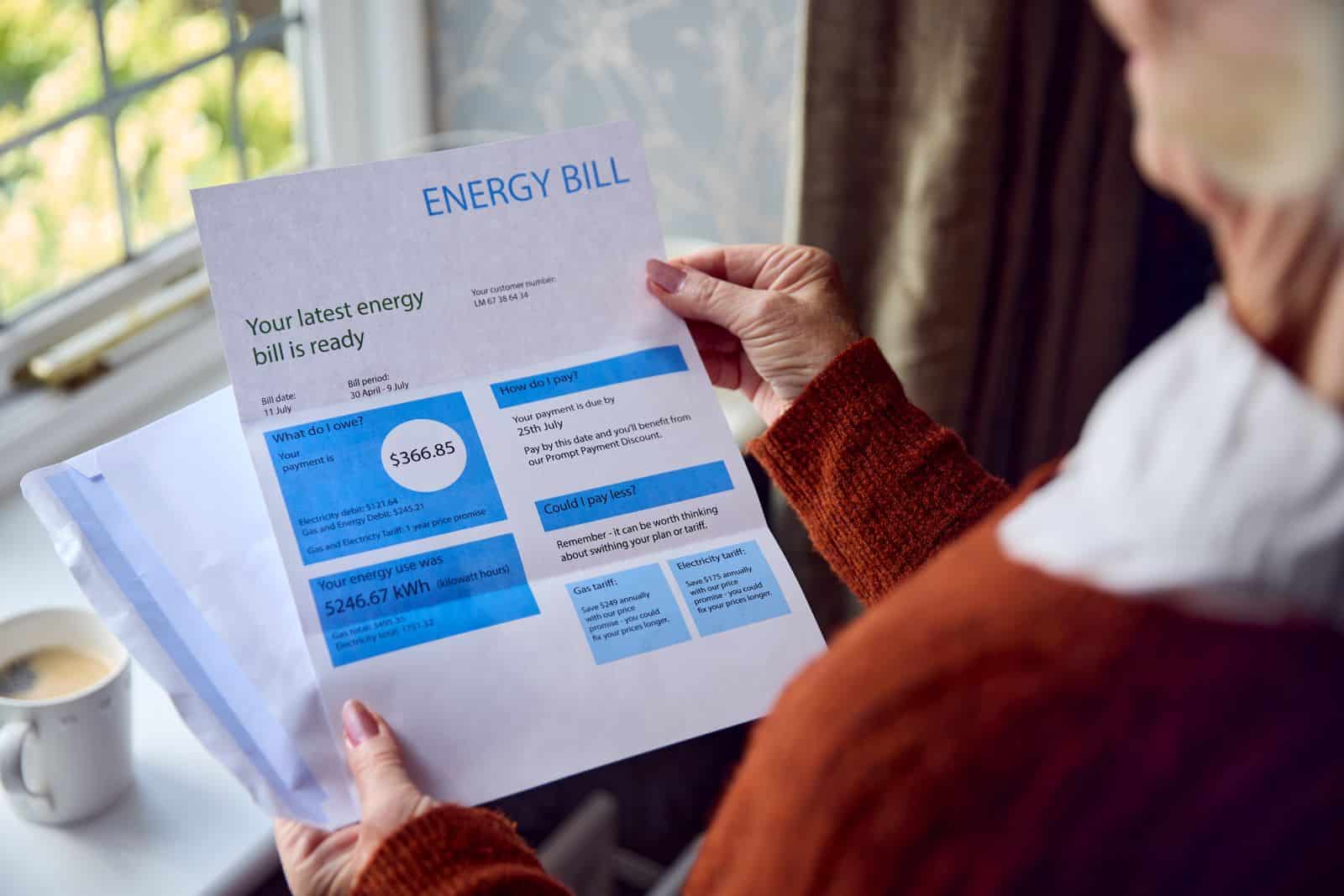

Increased Cost of Utilities

For example, electricity, water, and sewer utility rates have increased exponentially in almost every corner of the country. Those generally are unavoidable expenses, but have become seriously burdensome for a large portion of Americans.

The Credit Card Trap

Experts worry that the increased reliance on credit cards is digging a hole for consumers that won’t be easily escaped. The more you borrow, the more you’ll pay in interest, and as that compounds over time, it gets more and more difficult to pay it all off.

Rising Rates of Late Payments

The New York Federal Reserve confirms that credit card payment delinquency is becoming a significant problem as more Americans fall behind.

To Pay or Not To Pay

As the aforementioned necessities like food and utilities continue to rise in price, people are forced to re-evaluate where they spend money set aside for credit card payments.

Late Payments Highest In Over a Decade

As a result, there are currently more credit cards with payments more than 90 days late than there have been in over a decade. Presumably, inflation combined with unchanged wages has contributed to this statistic.

The Dangers of Paying Late

The issue continues to snowball. When credit card payments are missed, credit scores decrease. As lenders see your credit scores decrease, they can increase the interest rate on other cards, even if you haven’t missed any payments on those.

A Broken System

The system is ultimately designed in such a way that it is quite easy to get into debt, but very difficult to get out of it. Those struggling with unmanageable debt are urged to seek professional help to find ways to reduce it.

Remote No More: 19 Companies Returning to the Office

As the pandemic wanes, companies are recalling remote workers back to the office, sparking debates on fairness, costs, and convenience. However, there are also notable productivity, coworking, and mental health benefits to consider. Feeling the effects of these changes? Remote No More: 19 Companies Returning to the Office

8 Costco Must Buys and 8 to Leave Behind

Ever wandered Costco’s aisles, questioning if that giant jar of pickles is a real bargain? Or debated buying tires where you get your rotisserie chicken? Welcome to the definitive guide to Costco shopping—a journey to save money, prevent regrets, and offer quirky insights into bulk buying. 8 Costco Must Buys and 8 to Leave Behind

23 Reasons Texas Is the Next Big Thing

Texas is becoming a beacon of opportunity, blending cultural heritage with economic growth. From its landscapes to its industries, the Lone Star State offers a dynamic lifestyle. Here are 23 reasons why Texas stands out, attracting entrepreneurs, artists, tech professionals, and families seeking new beginnings. 23 Reasons Texas Is the Next Big Thing

The post Credit Card Debt Soars as Inflation Hits Americans Hard first appeared on Liberty & Wealth.

Featured Image Credit: Shutterstock / christinarosepix.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.