The national average credit score has dropped for the first time since 2013 – and while it may not be a cause for national concern yet, it is an indication of growing financial stress for the average American.

Average Credit Score Drops

For the first time in ten years, the national average FICO credit score in the U.S. has dropped, giving insight into how higher interest rates and prices are straining consumer finances.

718 to 717

The national average credit score has been 717 since October, down 1 point from the 718 average in July.

First in a Decade

The last time credit scores dropped was over ten years ago during the last U.S. housing crisis, when average credit scores across the country fell as low as 686 due to mass foreclosures in 2013.

Covid Stimulus

Average credit scores have continued to climb since then and even remained stable throughout the COVID-19 pandemic when the government was injecting stimulus money into the economy to keep households afloat.

Forbearance Support

Postponements on debt repayments from banks and credit card companies during this period also made a significant difference.

However, in the last two years, a changing economy has meant that millions of people have used up these COVID cash reserves.

Removed From the Pandemic

“We are pretty far removed from pandemic-level mitigation programs, so consumers are very much confronted with making good on their credit obligations,” said Ethan Dornhelm, FICO vice president of scores and predictive analytics.

“With little in the way of stimulus checks or government-defined accommodation programs.”

Increased Financial Stress

While this drop is much less severe, it does indicate some concerning economic truths for the average American – namely, that financial stress is increasing for millions of people around the country.

Higher Interest Rates Add Pressure

As the Federal Reserve raises interest rates to fight inflation and the cost of living crisis continues, consumers are feeling the strain on their pockets and savings accounts.

Where We See It

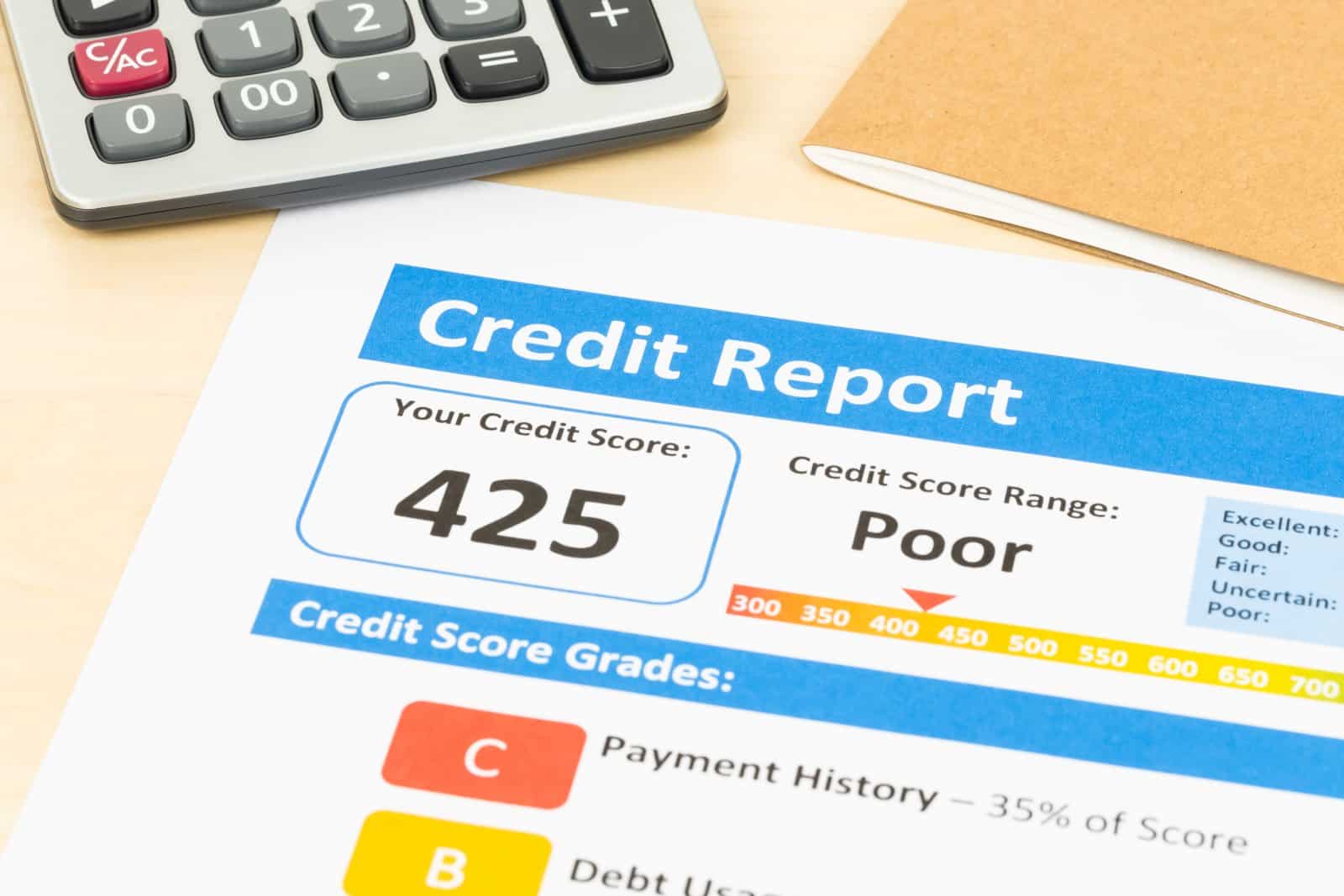

This is showing up in national credit score averages due to increased reliance on credit cards, an uptick in missed payments, and more outstanding debt.

Missed Payments, More Debt

According to FICO data, more people are missing payments on their credit reports and using higher amounts of credit to pay the bills and sustain their lifestyles during economic uncertainty.

Increased Late Repayments

Data shows that as of October 2023, more than 18% of consumers had made late payments of 30 days or more on at least one credit account in the previous year.

Higher Than Pre-Pandemic Levels

This number is 4% higher than it was in April 2023 and is higher than it was before the pandemic.

Credit Utilization Ratio Rises

The same data also shows that the average American credit utilization ratio, which is the percentage of your available credit that you actively use, is now at 35%.

This means the average consumer is using 35% of the credit available to them.

Keep It 30% or Lower

This is an issue as financial and credit experts typically recommend keeping your utilization rate at 30% or lower to keep it from negatively affecting your credit score.

“Starting to Weigh on Customers”

In the most recent FICO report on average credit scores, the company’s director of scores and predictive analytics, Can Arkali, wrote, “The effects of high interest rates and persistent inflation may be starting to weigh on consumers, especially those already struggling to manage their finances.”

Keep An Eye on the Numbers

While Arkali and other experts have denied that these recent numbers are a bad omen for the U.S. economy, he does believe that the government and economists should keep a close eye on these numbers in the coming year.

Shouldn’t Raise Alarms

“While this is a notable milestone, it’s not a drastic decrease and not one that should sound an alarm,” he explained.

Record-High Credit Card Debt

The New York Federal Reserve has reported record-high credit card debt, which stood at $1.1 trillion as of December.

A Concern for the Average American

Increased credit card debt and lower credit scores may not be an immediate red flag for the economy overall, but it is a concerning reality for average Americans who rely on a ‘good’ credit card score to qualify for various financial products and even housing.

“Difficult in the Current Economy”

“The lower the credit score the less likely you could get approved for financing and the higher your interest rate is going to be,” says Anna Kaplan, founder of lending and financing software iFinance.

“It’s difficult in this current economy not to have a good credit score.”

The post U.S. Credit Scores Decline for the First Time in Ten Years first appeared on Liberty & Wealth.

Featured Image Credit: Shutterstock / fizkes.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.