GM decided to use the $6 billion they had available to buy back stock instead of investing in the development of new EVs. The competition is rife. Can they really afford to do this? Here’s the story.

GM Strategy or Bust?

GM might not have used the billions it had to build new EVs, but it stuck to its strategy of buying back some stocks on the open market. The car manufacturer had $6 billion on hand which was previously approved to buy back stocks. Was this the best move to make?

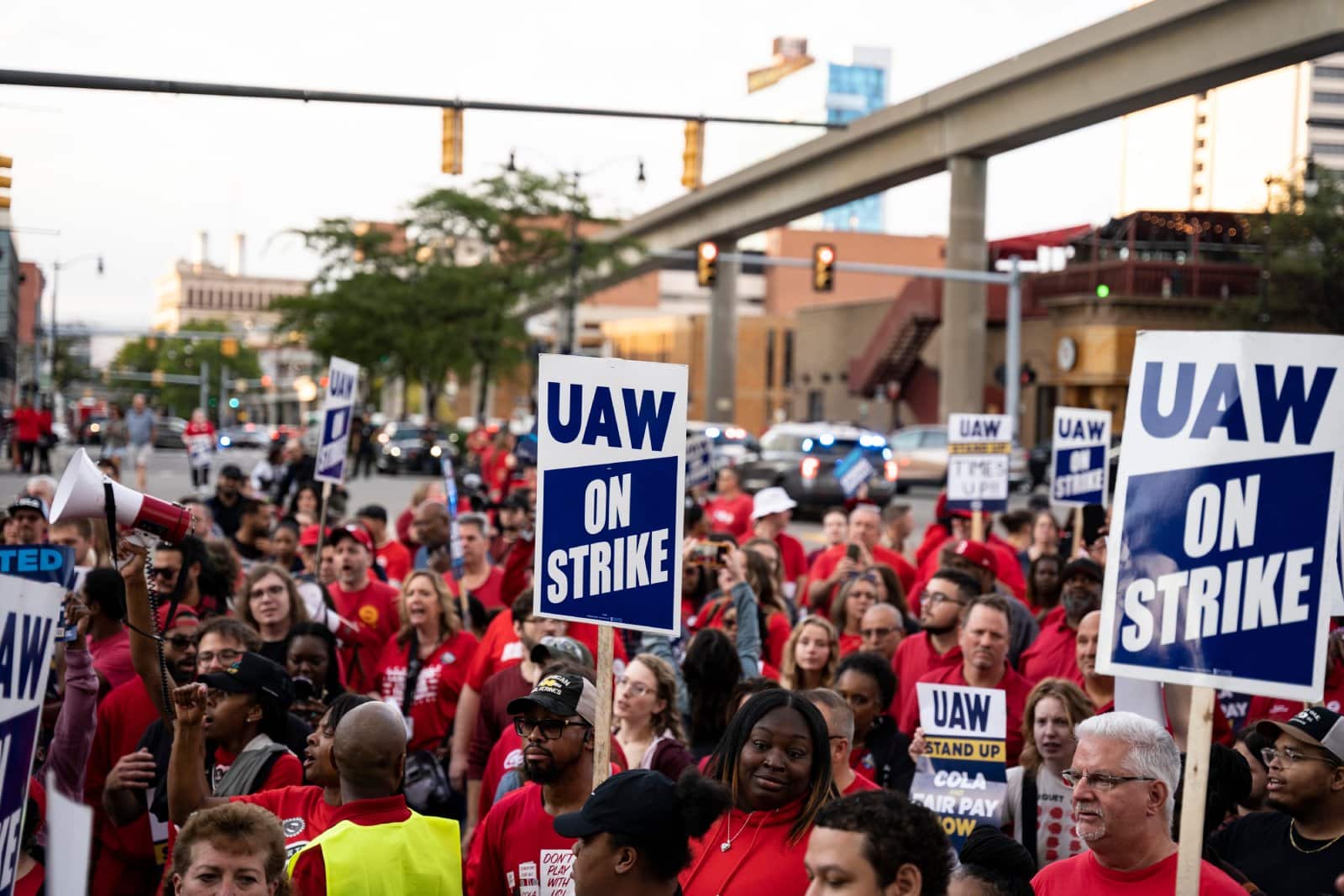

Some Former Challenges: UAW Strike Delayed Production and Cost Billions

GM dealt with the UAW (United Auto Workers) strikes at the end of 2023. The strike impacted the GM Arlington Texas Assembly Plant which is one of the manufacturer’s largest plants. During the strike more than 45,000 workers dropped tools for an increase in wages.

What Did GM Spend on Strike?

The strike might have been last year and lasted for six weeks, but it’s impacted the auto manufacturer financially. Auto News reported that GM spent an estimated $1.1 billion compensating for the loss of production and increased wages.

Focused on Their Portfolio and Growing the Business

According to reports from GM’s pressroom, the car manufacturer’s CFO, Paul Jacobson, said, “… we are growing and improving the profitability of our EV business and deploying our capital efficiently…” GM is also working towards building its portfolio with a focus on profitability for its ICE Truck business.

Stock Buyback Plan In Full Swing

The car manufacturer’s board has collectively agreed to a stock buyback plan worth $10 billion. The first stock buyback took place for $6 billion. CFO for GM, Paul Jacobson said in a news release that the strategy allows the company to “…continue returning cash to shareholders.”

Stock Dividend Increase

GM has also managed to increase its common stock from $0.09 to $0.12 per share within the first quarter.

Meanwhile, Competition Moves Ahead

GM has had setbacks with staff strikes and has seen its competition race forward with its cars hitting showrooms across America.

Slow On EV Production

Unlike its rivals, GM takes a slower approach to developing new EVs. The company reported that the demand for EVs is lower this year, with only 200,000 – 250,000 expected. It also noted that older targets required 300,000 and even 400,000.

Stocks Doing Better Than Rivals

Stock reports have seen GM’s stock increase in value, especially after the announcement of the buyback of stocks. Stocks valued at $46.7 and have dipped slightly by 1.85% as of June 15, 2024, Friday.

Rivals Ford and Stellantis

Ford and Stellantis stocks have not seen the same growth as GM’s. Ford’s stock value as of June 25, 2024, is 11.71, and Stellantis’ is 18.82.

Set to Invest in More Stock Buybacks

The company has reported that it will use the balance of its buyback budget of $1.1 by the end of June. GM is set to continue with its stock buyback plan and renew another $6 billion for the cause.

The Competition Is Real and Big on Affordability

Other car manufacturing companies like Kia is making affordable cars and redesigning them for an efficient EV approach. Hyundai and Tesla have made affordable electric vehicles that cost under $47,000, according to Electrek.

Will GM Still Make EVs?

In a shareholder meeting, GM’s CEO Mary Barra said that GM remains committed to Electric Vehicles. Despite the slow demand in the industry, the company has confirmed positive feedback on sales in May in the North American region.

Some EV Bestsellers for GM

GM brands like the Chevrolet Silverado, the GMC Hummer, the Cadillac Lyriq, and the Chevrolet Blazer are some of the bestselling vehicles. Starting at $35,000, the Chevrolet Equinox is the entry-level EV with the mass market and competition in mind for affordable EVs.

Rivals Making New EV SUVs

GM rival Stellantis says they’re moving ahead even though the market and microeconomy are challenging. Stellantis CEO Carlos Tavares says the company’s goal is to offer a $25,000 EV in the form of a Jeep. It will be one of the more affordable vehicles aimed at the larger market.

Remote No More: 19 Companies Returning to the Office

As the pandemic wanes, companies are recalling remote workers back to the office, sparking debates on fairness, costs, and convenience. However, there are also notable productivity, coworking, and mental health benefits to consider. Feeling the effects of these changes? Remote No More: 19 Companies Returning to the Office

8 Costco Must Buys and 8 to Leave Behind

Ever wandered Costco’s aisles, questioning if that giant jar of pickles is a real bargain? Or debated buying tires where you get your rotisserie chicken? Welcome to the definitive guide to Costco shopping—a journey to save money, prevent regrets, and offer quirky insights into bulk buying. 8 Costco Must Buys and 8 to Leave Behind

23 Reasons Texas Is the Next Big Thing

Texas is becoming a beacon of opportunity, blending cultural heritage with economic growth. From its landscapes to its industries, the Lone Star State offers a dynamic lifestyle. Here are 23 reasons why Texas stands out, attracting entrepreneurs, artists, tech professionals, and families seeking new beginnings. 23 Reasons Texas Is the Next Big Thing

15 Top Sites to Sell Your Unwanted Goods Besides Craigslist

Selling your unwanted items can declutter your space and boost your income. While Craigslist is popular, there are many alternatives with unique features and wider audiences. Explore these 15 Craigslist alternatives for selling everything from furniture to electronics, finding the perfect platform to turn clutter into cash. 15 Top Sites to Sell Your Unwanted Goods Besides Craigslist

Work from Anywhere: 19 Companies Still Supporting Remote Work

Tired of commuting and craving work flexibility? You’re not alone. Many companies now offer remote work, benefiting both employees and employers. Ever wondered how this shift could enhance your work-life balance? Work from Anywhere: 19 Companies Still Supporting Remote Work

The post GM’s $6 Billion Miss: Why Stock Buybacks Over EVs Could Cost Them first appeared on Liberty & Wealth.

Featured Image Credit: Shutterstock / Jonathan Weiss.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.