As the Federal Reserve holds off on raising interest rates, there’s still a cloud of financial uncertainty looming. Let’s break down what all this borrowing means for Americans, especially with elections around the corner.

Rate Pause Explained

The Federal Reserve might not raise interest rates further, but that doesn’t mean rates will stop climbing.

U.S. Government’s Heavy Borrowing

The government borrowed $1 trillion in just the last quarter. This constant need for funds has implications for all of us.

Effects on Debt and Deficit

The increasing borrowing rates will further inflate the country’s debt and deficits, affecting economic stability.

Uncertainty in the Budget

Experts are scrutinizing the federal budget closely, questioning the sustainability of such high levels of borrowing.

Market’s Demands

Financial markets are demanding higher returns on U.S. debt, which will increase the overall borrowing costs for the country.

Pressure on Political Leaders

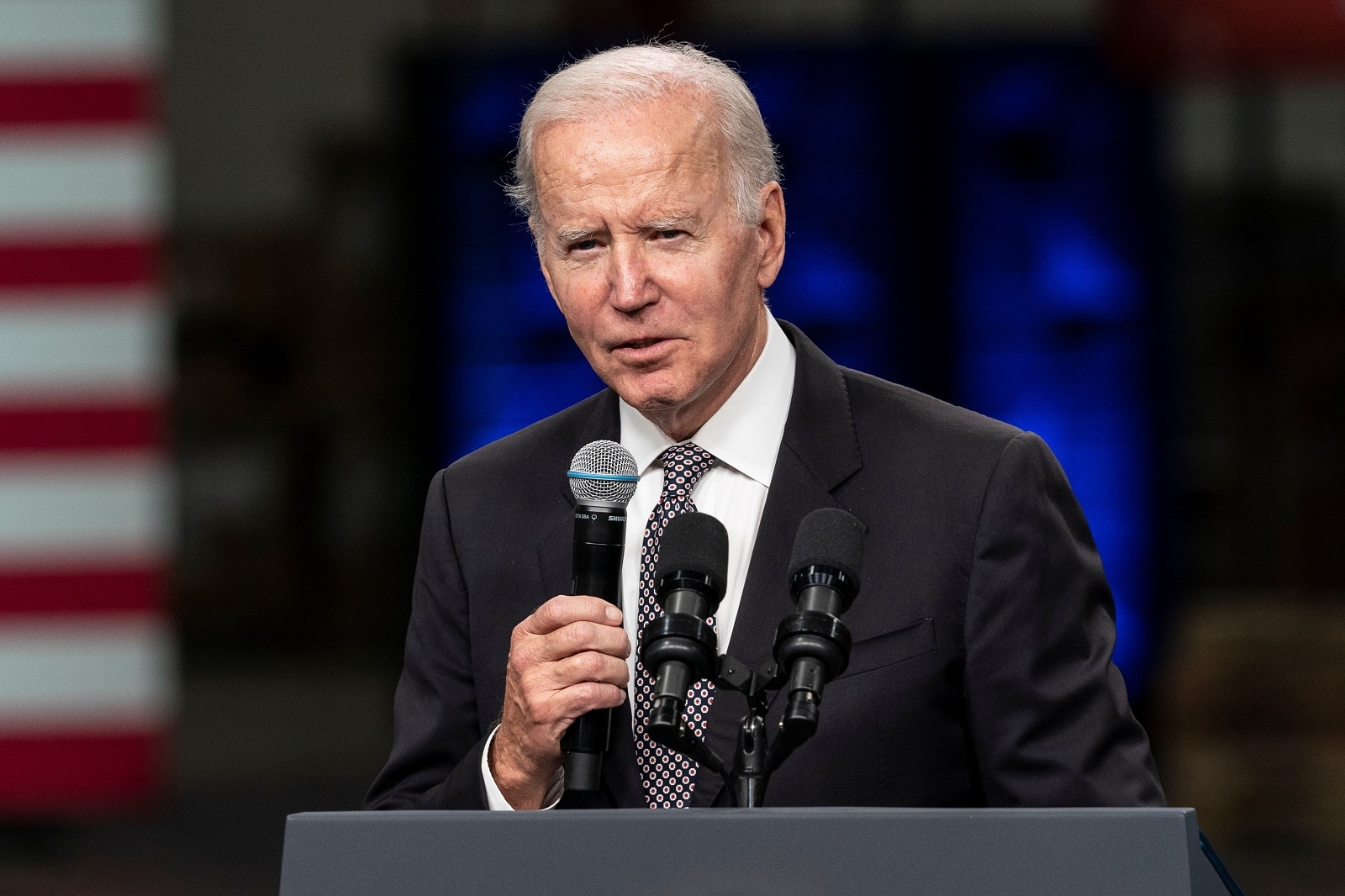

This situation increases the pressure on President Biden and Congress to reduce the deficit, which seems unlikely given current political divisions.

Political Dysfunction

The ongoing lack of agreement between Democrats and Republicans has made experts pessimistic about the country’s financial future.

Treasury’s Future Plans

The U.S. Treasury has plans to borrow even more: $776 billion for the last quarter of this year and $816 billion in the first quarter of 2024.

Risk of Government Shutdown

This comes at a time when there’s a real danger of a government shutdown due to disagreements over federal spending.

Supply and Demand

The rising yields on government bonds are not solely due to the deficit but are also affected by the supply of and demand for these bonds.

Fed’s Role

The Federal Reserve’s decision to reduce its own holdings of government debt means fewer buyers, leading to higher yields.

No Panic Yet?

Not everyone is alarmed. Some experts argue that the current debt situation is more manageable than in previous years.

Long-Term Impacts

The longer the rates stay high, the larger the volume of debt. This will affect the economy’s growth and pace.

Effect on Economic Activity

Rising rates can slow down economic activities, affecting jobs and consumer spending.

Outlook for Inflation

The state of the economy will determine future inflation rates and subsequently how long the current high rates will last.

Hard to Predict

Experts are finding it difficult to predict how long the current rate scenario will continue, adding to the financial uncertainty.

Far-Reaching Consequences

The U.S. government’s borrowing habits have far-reaching consequences that can’t be ignored.

With the Fed holding off on increasing rates, all eyes are on how this will play out in the months to come, especially as political pressures intensify.

Crucial for Americans

It’s important for American citizens to understand the implications as they may hit closer to home than you think.

The post Government’s $1 Trillion Borrowing Frenzy Is Only Getting Worse first appeared on Liberty & Wealth.

Featured Image Credit: Shutterstock / J.J. Gouin.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.