A new policy proposal from the Biden team could lead to millions of Americans finally getting their financial standing under control.

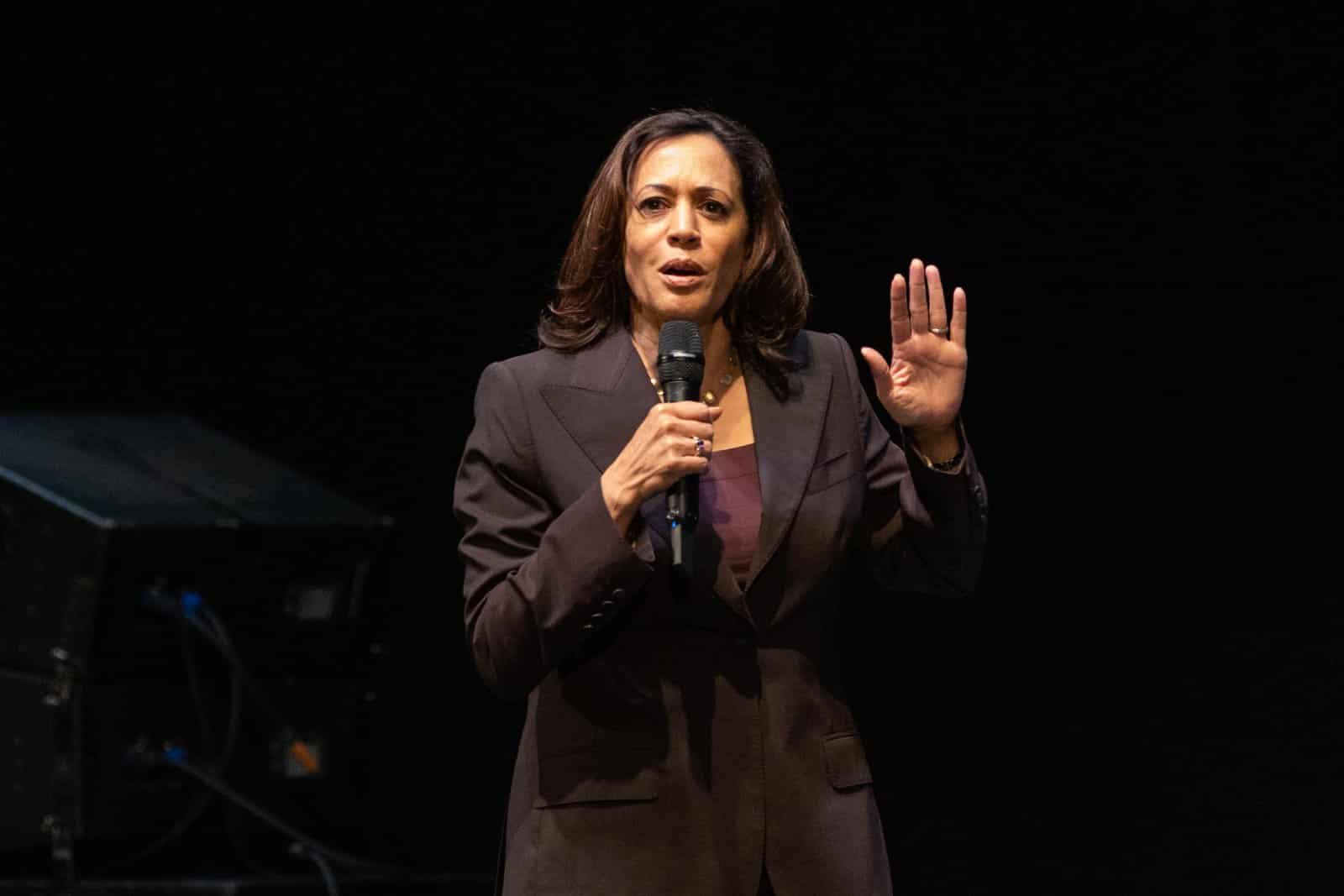

A Transformative Move to Wipe Medical Debt Off Credit Reports

In a move that could transform the lives of millions, Vice President Kamala Harris and Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra just announced a plan to wipe medical debt off credit reports.

Boosting Credit Scores and Mortgage Approvals

This is a major overhaul that could boost credit scores for millions and lead to thousands of new mortgage approvals each year.

Building on the Success of the American Rescue Plan

It’s a plan that builds on the American Rescue Plan (ARP), which has already slashed $7 billion in medical debt for nearly 3 million Americans.

Medical Debt’s Long-Standing Impact on Credit Scores

Medical debt has been a problem for Americans for years, dragging down credit scores and even pushing some people into bankruptcy.

Disproportionate Impact on Veterans, Seniors, and Minority Communities

According to the Biden administration, medical bills are often wrong or unfairly charged and typically hit veterans, older adults, and minority and low-income communities the hardest.

Leveling the Playing Field

By taking medical debt off credit reports, they’re hoping to level the playing field and offer these groups better access to credit, housing, and healthcare – ultimately giving people a fresh start.

Hoping to Offer a Fresh Start to Millions

The CFPB’s proposal could help over 15 million Americans get rid of medical debt on their credit reports, bumping their scores up by about 20 points on average. This change could lead to the approval of roughly 22,000 new mortgages each year.

Anticipating a Massive Credit Shift

Once this plan goes into action Americans will witness one of the biggest credit shifts of all time. In 2020 46 million people reported medical debt on their credit reports. Many of these could wake up one day to none at all.

States and Local Governments Urged to Join Efforts

Harris isn’t stopping at just the federal level. She’s urging states, local governments, and healthcare providers to step up and help further destroy medical debt.

Erasing Medical Debt Using Public Funds

Her game plan? Use public funds to buy and erase medical debt, make charity care more accessible, and crack down on aggressive debt collectors.

ARP’s Role

In a public policy announcement, Harris explained how the ARP has played a key role in reducing medical debt. Funds from the plan have already been used to cancel billions in medical debt in states around the country and will continue to be used for that purpose until the end of 2026.

States Leading the Charge

Some states and cities that have already made significant headway with ARP funds are: Arizona: Slashed up to $2 billion in medical debt for 1 million people. Cook County, Illinois: Cleared up to $1 billion in debt for 400,000 residents. New Jersey: Budgeted millions to cut up to $1 billion in medical debts, helping out 400,000 residents.

Successful ARP Implementation Across Various States

Connecticut: Wiped out up to $650 million in medical debt for 250,000 residents. Wayne County, Michigan: Eliminated up to $700 million in debt for 200,000 residents. Orange County, Florida: Relieved up to $450 million in medical debt for over 150,000 residents. Oakland County, Michigan: Used ARP funds to clear up to $200 million in debt for 80,000 residents.

Pushing for Stricter Debt Collector Regulations

The Biden administration is also pushing for tighter regulations for debt collectors. Millions of people get harassed by debt collectors every year, facing lawsuits, wage garnishments, and huge interest rates.

Cracking Down on Unfair Practices

The CFPB is cracking down on these unfair practices and making sure these collectors follow the law.

Congressional Opposition

The administration’s plan has not been well received by everyone – especially Congressional Republicans.

Controversy Over Medicaid, Medicare, and ACA Funding

The recent budget proposal from the Republican Study Committee – which represents 100% of House Republican leadership and around 80% of Republican members – detailed how they would cut Medicaid, Medicare, and the Affordable Care Act, as well as defund the CFPB in a move to totally oppose eliminating medical debt.

A Potential Game-Changer

If the CFPB’s new rule goes through, medical debt could vanish from credit reports entirely. This is all part of the administration’s broader push to lower healthcare costs and improve Americans’ financial security.

Past Efforts

In the past, Biden’s government made ACA coverage cheaper, expanded Medicaid, and put protections in place to stop surprise medical bills. According to a White House report, their efforts have already cut the number of households with medical debt on credit reports from 46 million to 15 million.

Legislative Hurdles Ahead

For now, all eyes are on the Biden administration as they work towards getting this legislation through Congress.

Remote No More: 19 Companies Returning to the Office

As the pandemic wanes, companies are recalling remote workers back to the office, sparking debates on fairness, costs, and convenience. However, there are also notable productivity, coworking, and mental health benefits to consider. Feeling the effects of these changes? Remote No More: 19 Companies Returning to the Office

8 Costco Must Buys and 8 to Leave Behind

Ever wandered Costco’s aisles, questioning if that giant jar of pickles is a real bargain? Or debated buying tires where you get your rotisserie chicken? Welcome to the definitive guide to Costco shopping—a journey to save money, prevent regrets, and offer quirky insights into bulk buying. 8 Costco Must Buys and 8 to Leave Behind

23 Reasons Texas Is the Next Big Thing

Texas is becoming a beacon of opportunity, blending cultural heritage with economic growth. From its landscapes to its industries, the Lone Star State offers a dynamic lifestyle. Here are 23 reasons why Texas stands out, attracting entrepreneurs, artists, tech professionals, and families seeking new beginnings. 23 Reasons Texas Is the Next Big Thing

15 Top Sites to Sell Your Unwanted Goods Besides Craigslist

Selling your unwanted items can declutter your space and boost your income. While Craigslist is popular, there are many alternatives with unique features and wider audiences. Explore these 15 Craigslist alternatives for selling everything from furniture to electronics, finding the perfect platform to turn clutter into cash. 15 Top Sites to Sell Your Unwanted Goods Besides Craigslist

Work from Anywhere: 19 Companies Still Supporting Remote Work

Tired of commuting and craving work flexibility? You’re not alone. Many companies now offer remote work, benefiting both employees and employers. Ever wondered how this shift could enhance your work-life balance? Work from Anywhere: 19 Companies Still Supporting Remote Work

The post Removing Medical Debt From Credit Reports Could Be A Game-Changing Move From the Biden Administration first appeared on Liberty & Wealth.

Featured Image Credit: Pexels / Anna Shvets.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.